Every Sunday I send out a free weekly watchlist of the hottest stocks I’m watching. Investors often use the Current Ratio to gauge a company’s financial stability and its ability to weather economic downturns. A strong Current Ratio can instill confidence in potential investors, but it should be evaluated alongside other financial metrics and the company’s specific circumstances. The prevailing view of what constitutes a “good” ratio has been changing in recent years, as more companies have looked to the future rather than just the current moment.

Ask a Financial Professional Any Question

My Trading Challenge students get access to webinars, video lessons, my DVDs, my incredible chat room, and more. Every industry has different ratio averages based on factors that can tell you about a company’s overall health. Therefore, you CAN calculate and perform interpretations every quarter.

Do you already work with a financial advisor?

Some lenders and investors have been looking for a 2-3 ratio, while others have said 1 to 1 is good enough. It all depends on what you’re trying fix the process not the problem to achieve as a business owner or investor. If a company has a current ratio of 100% or above, this means that it has positive working capital.

Would you prefer to work with a financial professional remotely or in-person?

Similarly, companies that generate cash quickly, such as well-run retailers, may operate safely with lower current ratios. They may borrow from suppliers (increasing accounts payable) and actually receive payment from their customers before the money is due to those suppliers. For example, Walmart had a 0.83 current ratio as of January 2024. In this case, a low current ratio reflects Walmart’s strong competitive position. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition.

Formula in the ReadyRatios Analysis Software

In general, a current ratio between 1.5 and 3 is considered healthy. Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital. These are future expenses that have been paid in advance that haven’t yet been used up or expired.

How to Calculate the Current Ratio in Excel

- Fundamentals are often overlooked, but they can tell you a lot about a company over time.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- This split allows investors and creditors to calculate important ratios like the current ratio.

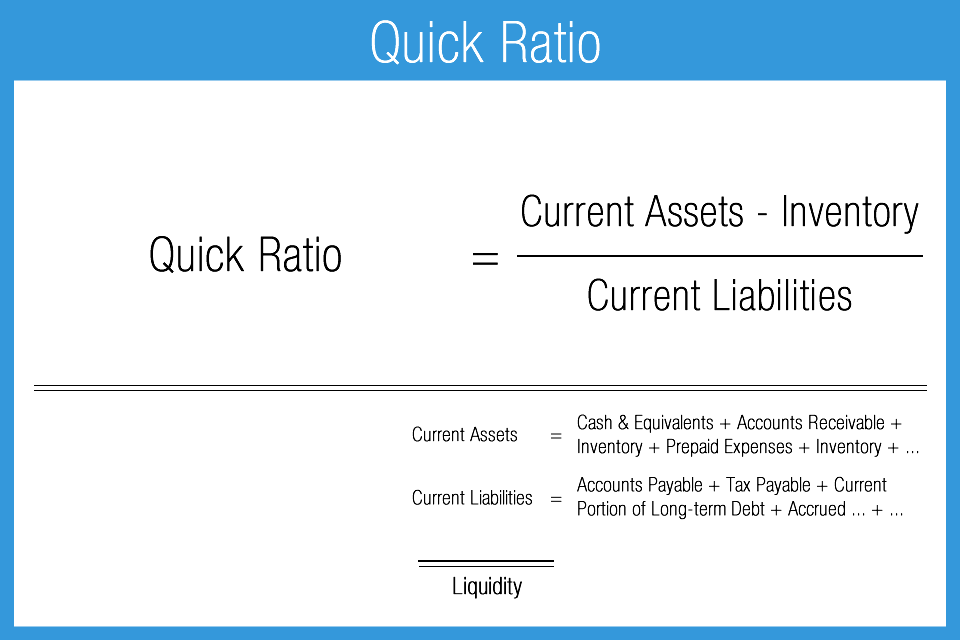

By examining multiple liquidity ratios, investors and analysts can gain a more complete understanding of a company’s short-term financial health. Current assets include only those assets that take the form of cash or cash equivalents, such as stocks or other marketable securities that can be liquidated quickly. Current liabilities consist of only those debts that become due within the next year. By dividing the current assets by the current liabilities, the current ratio reflects the degree to which a company’s short-term resources outstrip its debts. The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm’s current debt in terms of current assets.

The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. I have compiled below the total current assets and total current liabilities of Thomas Cook. You may note that this ratio of Thomas Cook tends to move up in the September Quarter. After consulting the income statement, Frank determines that his current assets for the year are $150,000, and his current liabilities clock in at $60,000. By dividing the assets of the business by its liabilities, a current ratio of 2.5 is calculated.

Though they may appear to have the same level of risk, analysts would have different expectations for each company depending on how the current ratio of each had changed over time. ” analyzed the complete transaction history of the Taiwan Stock Exchange between 1992 and 2006. Additionally, it tied the behavior of gamblers and drivers who get more speeding tickets to overtrading, and cited studies showing that legalized gambling has an inverse effect on trading volume. Regardless of why you’re looking at it, you want it to be at least 1.0.

There’s a decent chance you’ve heard of the current ratio — and other liquidity ratios. People look at fundamentals and SEC filings and just blow them off cause they’re boring. Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. This may not always be the case, especially during economic recessions.