By unconventional, we mean a stream that has more than 1 negative cash flow. You’ll want to use the “pmt” option when you’ve got an annuity stream of cash flows. Remember that the Net Present Value and the discount rate have a negative relationship, so that the ascension providence covid pfizer vaccine 1 schedule q NPV decreases as the discount rate increases, and increases as the discount rate decreases. Note that this formula to calculate IRR only works for a single cash flow. In the spreadsheet, project A results in an IRR of 17%, and project B results in an IRR of 5%.

How to use the IRR? (IRR Rules for Acceptance of Projects)

The IRR equation allows an easy way for investors to see whether the discount rate and yield on an investment is worth pursuing without calculating the full NPV. The IRR equation allows an easy way for investors to see whether the discount rate and yield on an investment are worth pursuing without calculating the full NPV. Once the annual yield is listed, the IRR can be calculated by searching it in the functions menu in Excel and selecting the cells with the initial investment and annual yield as the input into the “Values” section. The internal rate of return is commonly used to compare and select the best project. The project with an IRR above the minimum acceptable return (hurdle rate) is selected. The IRR is more helpful in comparative analysis than in isolation as one single value.

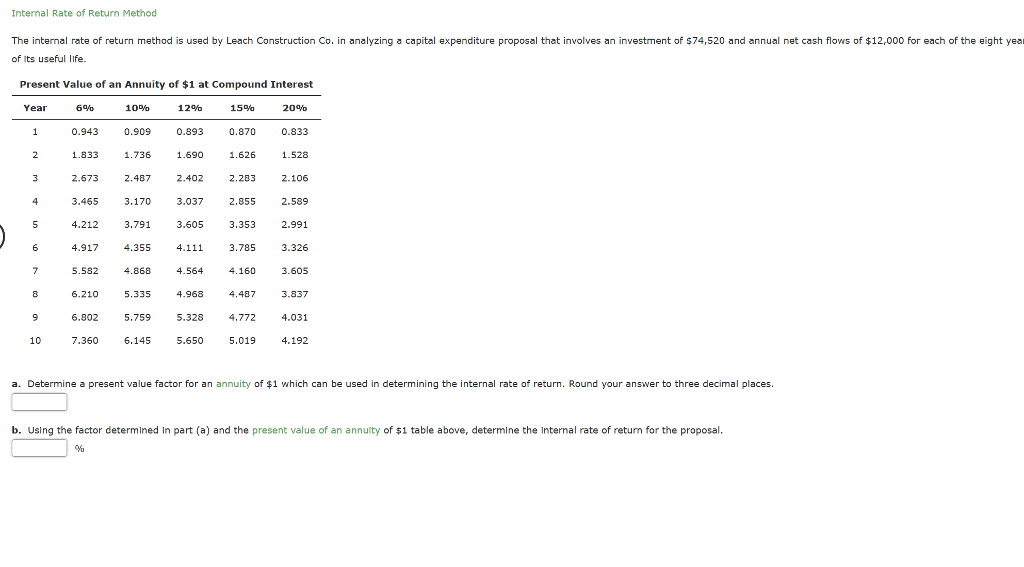

Calculating IRR Case Study

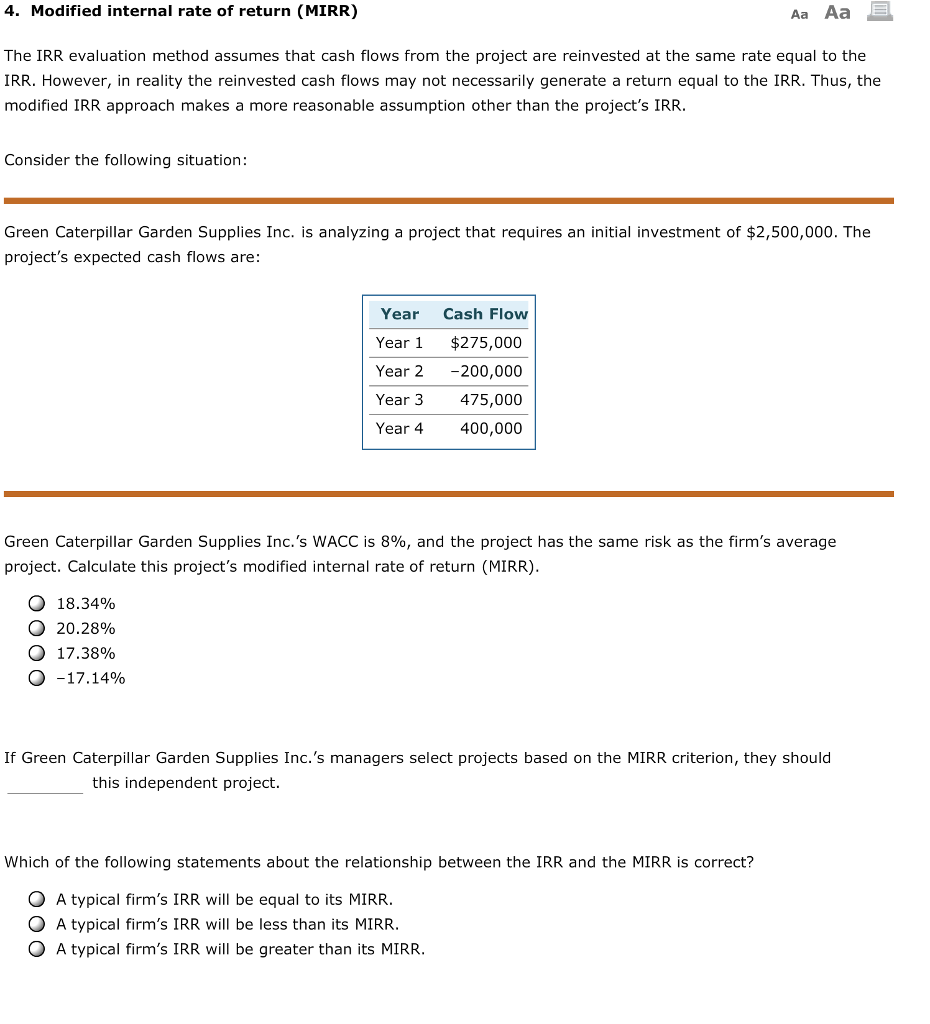

Using the IRR formula in a spreadsheet application is a potent way to assess the profitability and feasibility of investments. Using the IRR function, you can easily calculate the internal rate of return based on a series of cash flows. One notable drawback is that IRR assumes that all cash flows are reinvested at the same rate as the IRR itself, which isn’t realistic. In addition, IRR can be misleading when comparing projects of different durations or sizes since it can’t account for the scale of an investment or the absolute dollar value of returns.

Calculating IRR

Remember to account for your risk tolerance, liquidity and diversification needs, and portfolio goals when deciding on your investments. The main difference between the IRR and NPV is that NPV is an actual amount, while the IRR is the interest yield as a percentage expected from an investment. If only IRR 1 was calculated, then the project would be rejected as the target is higher, but if IRR 2 was calculated, the project would be accepted. So when a project has two IRRs, there is ambiguity as to whether the project should be accepted or not. The hairdresser wonders whether it will be more profitable to buy all of that equipment or use her money to invest in her friend’s coffee shop with an expected return of 12%. It is important to note that the value of CF0 is always negative as it is the cash outflow.

If a firm can’t find any projects with an IRR greater than the returns that can be generated in the financial markets, then it may simply choose to invest money in the market. Think of IRR as the rate of growth that an investment is expected to generate annually. In reality, an investment will usually not have the same rate of return each year. Usually, the actual rate of return that a given investment ends up generating will differ from its estimated IRR. Both of these measurements are primarily used in capital budgeting, the process by which companies determine whether a new investment or expansion opportunity is worthwhile.

- It is a complex calculation usually done using computer software or advanced calculators.

- In other words, the IRR is more than the project’s required rate of return; therefore, it is a profitable investment.

- Such an objective would rationally lead to accepting first those new projects within the capital budget which have the highest IRR, because adding such projects would tend to maximize overall long-term return.

- The IRR is an indicator of the profitability, efficiency, quality, or yield of an investment.

How to use the IRR calculator

The IRR formula can be very complex depending on the timing and variances in cash flow amounts. Without a computer or financial calculator, IRR can only be computed by trial and error. IRR can help you evaluate the potential of a new investment or endeavor, as well as compare it with other options you might be considering. Just make sure you incorporate other analyses and consider using a calculator or Excel’s IRR function to ease the process. If you need help determining whether a new investment is a smart move or not, consider contacting a financial analyst or financial advisor. In most cases, investors use an IRR calculator or an Excel spreadsheet, which has a built-in function to determine a project’s IRR.

A company might also prefer a large project with a lower IRR to a small project with a higher rate because of the greater cash flows it will generate in dollar terms. The NPV represents the value of cash flows at a point in time in the past, present or (expected) future. Both the above are again widely used financial market tools that helps in investment analysis and capital budgeting.

To reiterate from earlier, the initial cash outflow (i.e. sponsor’s equity contribution at purchase) must be entered as a negative number since the investment is an “outflow” of cash. The internal rate of return (IRR) cannot be singularly used to make an investment decision, as in most financial metrics. The higher the internal rate of return (IRR), the more profitable a potential investment will likely be if undertaken, all else being equal. The IRR measures the compounded return on an investment, with the two inputs being the value of the cash inflows / (outflows) and the timing, i.e., the coinciding dates. It is often stated that IRR assumes reinvestment of all cash flows until the very end of the project. Finally, by Descartes’ rule of signs, the number of internal rates of return can never be more than the number of changes in sign of cash flow.