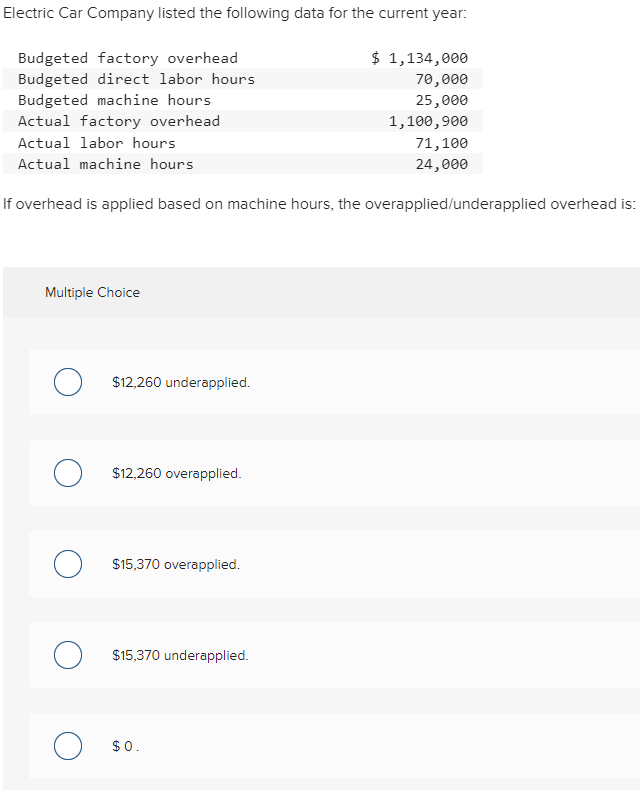

The opposite of overapplied overhead is underapplied overhead, which occurs when a company has applied more overhead to products than it has actually incurred. Similarly, the work in process inventory account and finished goods inventory account will also be added in the overapplied overhead journal entry. Learn effective strategies for managing overapplied overhead in cost accounting and its impact on financial statements. Over the long-term, best software for tax professionals the use of a standard overhead rate should result in some months in which overhead is overapplied, and some months in which it is underapplied. On average, however, the amount of overhead applied should approximately match the actual amount of overhead incurred. Depending on their production process, companies may express these costs as a rate per hour of machine time, a rate per hour of worker time or a per-unit cost, for example.

GAAP-Approved Costing Methods

Overapplied overhead is manufacturing overhead applied to products that is greater than the actual overhead cost incurred. Depending on materiality, overapplied overhead is either allocated between ending inventory and cost of goods sold or just written off to cost of goods sold. Subtract the budgeted overhead costs from the actual overhead costs to determine the applied overhead. Another significant implication is the need for continuous monitoring and variance analysis. Regularly comparing actual overhead costs to allocated amounts allows for timely identification of discrepancies.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Job order costing and overhead allocation are not new methods of accounting and apply to governmental units as well. See it applied in this 1992 report on Accounting for Shipyard Costs and Nuclear Waste Disposal Plans from the United States General Accounting Office. After this journal entry, the balance of manufacturing overhead will become zero.

Manufacturing Overhead

Overapplied overhead often signals that the predetermined overhead rate may need adjustment. This necessitates a thorough review of the allocation bases, such as direct labor hours or machine hours, to ensure they accurately reflect the actual consumption of overhead resources. By refining these allocation methods, companies can achieve more precise cost distribution, leading to better pricing strategies and cost control. Carbonic Corporation uses an overhead application rate that resulted in $15,000 of excess overhead being charged to produced units during its March reporting period.

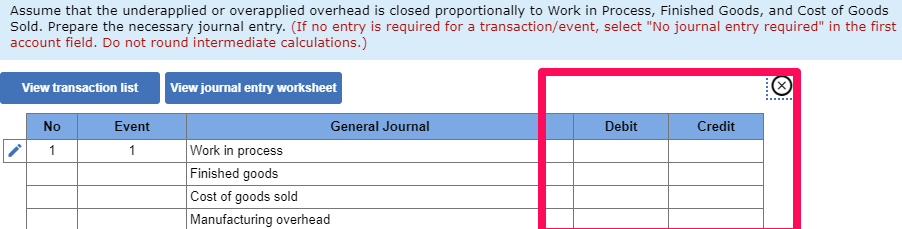

In financial terms, overapplied overhead results in a credit balance in the overhead account. This means that without the adjustment, the manufacturing overhead account will have a credit balance of $500 at the end of the period. Hence, we need to make the journal entry for the overapplied overhead of $500 by debiting that amount into the manufacturing overhead account to zero it out.

- If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead.

- Another strategy involves leveraging technology for real-time data analysis and monitoring.

- However, during the course of the year, production is more efficient than expected, and actual overhead costs only total $950,000.

- In this case we would, debit the factory overhead account and credit the cost of goods sold account for the difference.

What is Overapplied Overhead?

If actual overhead costs per hour are given, then multiply those costs per hour by the number of hours worked. For example, the actual overhead rate for a company is $10 an hour, Therefore, actual overhead is $10,000 by the equation $10 x 1,000 hours. When underapplied overhead appears on financial statements, it is generally not considered a negative event. Rather, analysts and interested managers look for patterns that may point to changes in the business environment or economic cycle. Should unfavorable variance or outcomes arise—because not enough product was produced to absorb all overhead costs incurred—managers will first look for viable reasons.

The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the cost of goods sold account at the period end adjusting entry. Overapplied overhead occurs when expenses incurred are actually less than what a company accounts for in its budget. This means that a company comes in under budget and achieves a lower amount of overhead costs during the accounting period. Actual overhead costs are found through company receipts for how much overhead costs. In an academic setting, problems from textbooks will often provide actual overhead costs per hour.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. He received a CALI Award for The Actual Impact of MasterCard’s Initial Public Offering in 2008.